Imagine a time when businesses relied entirely on owning and maintaining their own servers. Setting up infrastructure was a long and costly process. Scaling to meet growing customer demand meant buying new hardware and waiting weeks for it to arrive and be installed. Scaling down, on the other hand, left companies with expensive, unused equipment gathering dust.

This traditional approach was rigid and inefficient. It slowed innovation, making it difficult for businesses to adapt to changing market conditions or compete effectively.

Then came the cloud, a revolutionary way to access computing resources without owning hardware. With the cloud, businesses can rent servers, storage, and applications as needed, paying only for what they use. It’s like switching from owning a car to using ride-hailing services: flexible, fast, and cost-efficient.

✅ 90% of businesses now rely on the cloud to power their operations, according to a report by O’Reilly.

📊 Global spending on public cloud services is projected to reach $723 billion by 2025, as reported by Gartner.

🚀 The cloud enables businesses to innovate faster, expand their customer reach, and launch new products more efficiently.

But with this flexibility comes complexity. While the cloud is incredibly powerful, managing its costs requires more than just basic expense tracking. Businesses are discovering that their traditional methods of budgeting and IT management are not enough to keep cloud spending under control.

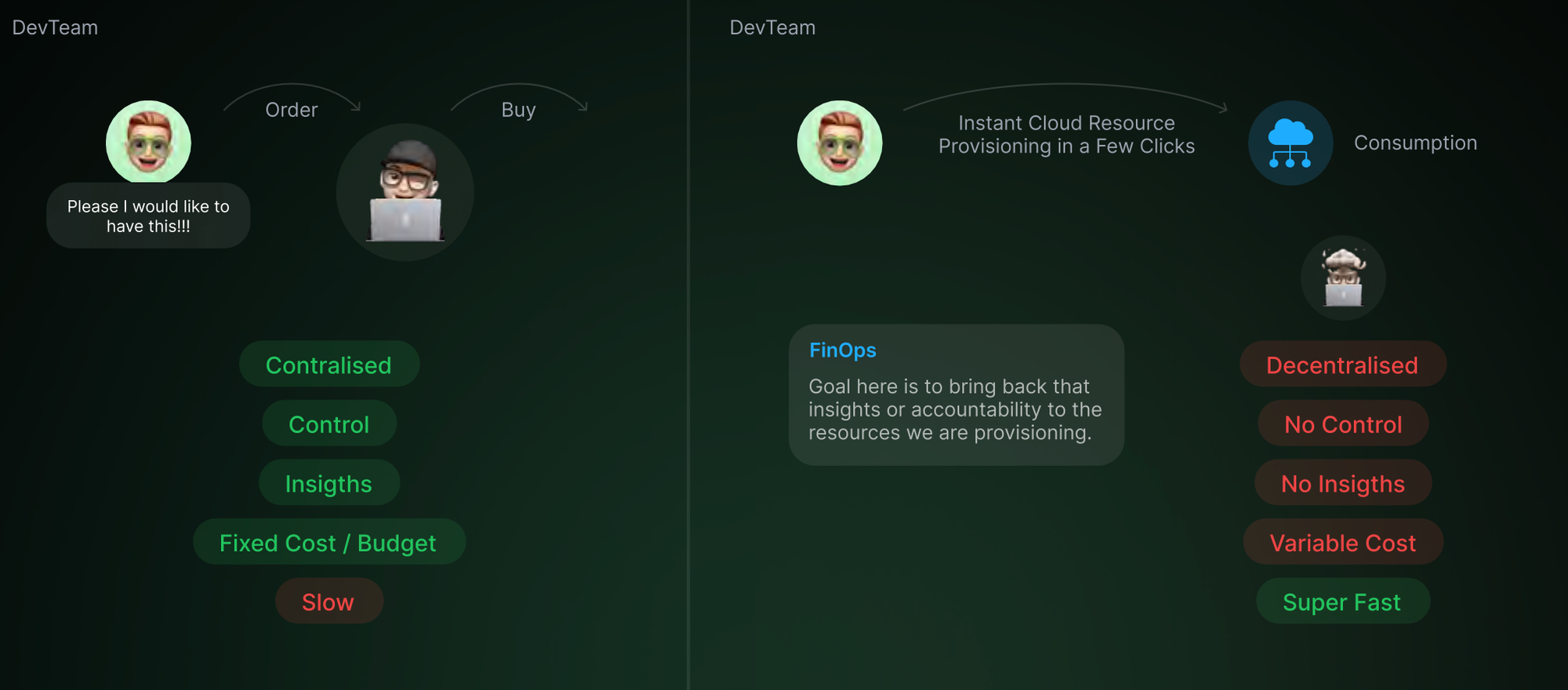

Why Is Managing Cloud Costs So Difficult?

Cloud costs are dynamic and can change based on usage. Unlike traditional IT systems with fixed costs, the cloud operates on a pay-as-you-go model. While this is an advantage for businesses seeking flexibility, it can lead to unpredictably high bills if not managed carefully.

For instance, a development team might create multiple servers for testing but forget to shut them down after the project ends. Or an engineering team might over-allocate resources to ensure smooth performance, unknowingly driving up costs. Without proper tools and visibility, these small actions can add up quickly.

✅ According to the 2023 State of the Cloud Report by Flexera, nearly 28% of cloud budgets are wasted annually.

That’s millions of dollars lost on unused or unnecessary resources simply because businesses lack the processes to track and manage their spending effectively.

This is where traditional methods of cost management fall short. Cloud costs require continuous monitoring, accountability, and collaboration across teams—a task too complex for manual tracking or outdated tools.

What Is FinOps, and How Does It Help?

FinOps is short for Financial Operations. It’s a framework designed to help businesses understand, control, and optimize their cloud spending.

Think of FinOps as a financial fitness program for your cloud usage. It’s not about restricting the use of cloud resources but about ensuring that every dollar spent delivers value. FinOps helps businesses answer three critical questions:

- What are we spending?

- Why are we spending it?

- What value are we getting in return?

For example, instead of running multiple servers all day, FinOps might reveal that scaling resources during peak hours is more cost-effective. It helps businesses align their cloud spending with their goals, ensuring resources are used efficiently.

Who’s Involved in FinOps?

FinOps is not just a set of tools-it’s a team effort. To manage cloud costs effectively, businesses need collaboration between several key roles:

Executive Leaders

These are the decision-makers who set the overall business goals. They ensure that cloud spending aligns with the company’s strategic objectives.

Finance Teams

The finance team’s role is to handle budgeting, forecasting, and cost tracking. They use reports and insights from FinOps tools to monitor cloud expenses and identify trends.

Engineering Teams

Engineers are the primary users of cloud resources. Their role is to optimize resource usage while maintaining performance and scalability. They play a critical part in implementing the recommendations provided by FinOps.

FinOps Practitioners

These individuals act as the bridge between finance, engineering, and leadership. They oversee the entire FinOps process, ensuring that all teams work together to achieve cost-efficiency. We’ll dive deeper into the role of FinOps practitioners later in this blog.

FinOps thrives on collaboration. It’s not about one team taking responsibility-it’s about all teams sharing accountability to make smarter cloud-spending decisions.

Real-Life Success Stories

Many companies have embraced FinOps to take control of their cloud spending.

✅ Airbnb reduced their storage costs by 27% by analyzing their usage patterns and optimizing their storage setup.

🚀 Lyft saved 40% on their cloud spending in just six months by using internal tools and leveraging AWS services.

💡 Etsy managed to cut their compute costs by 42% through committed usage discounts and optimization strategies.

These examples highlight how FinOps is not about limiting cloud usage but about making better choices that maximize value.

So, What Does a FinOps Practitioner Do?

We’ve introduced the broader roles involved in FinOps, let’s focus on the FinOps practitioner. This role is crucial because practitioners are the ones who make sure the framework runs smoothly.

Think of a FinOps practitioner as the bridge between technical teams and finance teams. They ensure that cloud spending is optimized, efficient, and aligned with the company’s business goals.

Their role is not just about saving money but about helping teams use cloud resources more wisely to drive maximum value.

Let’s take an example: Suppose a development team needs to test a new feature. They provision extra servers to ensure everything runs smoothly during testing. But after the testing is done, the servers are left running, incurring unnecessary costs. This is where the FinOps practitioner steps in. They would identify the over-provisioned resources, communicate with the team, and suggest shutting down the unused servers. This adjustment saves money without affecting the team’s performance or goals.

Being a FinOps practitioner is all about balancing technical expertise (like understanding how cloud resources work) with financial awareness (like knowing how to track and optimize costs).

It’s a role that involves collaboration, problem-solving, and staying proactive. As cloud adoption grows, this role is becoming increasingly important for businesses aiming to manage costs effectively.

How Do You Become a FinOps Practitioner?

Becoming a FinOps practitioner isn’t something you achieve overnight, but the journey is both exciting and rewarding. It’s a blend of technical expertise, financial acumen, and strategic decision-making-skills that are in high demand as businesses increasingly move to the cloud.

Ready to take the first step? Download our eBook and explore the Trail Map to Becoming a FinOps Practitioner-Your essential guide to cloud financial management firsthand!

📥 Download the eBook Now

Discussion